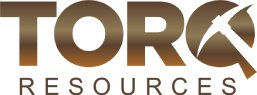

Vancouver, Canada – May 25, 2021 – Torq Resources Inc. (TSX-V: TORQ, OTCQX: TRBMF) (“Torq” or the “Company”) is pleased to announce that it has successfully acquired the option to earn a 100% interest in the Andrea copper porphyry project located in northern Chile, 100 kilometres (km) east of the city of La Serena. The property is located at the western margin of the Miocene aged El Indio belt that hosts the world-class El Indio and Pascua Lama epithermal gold and silver deposits (Barrick Gold Corporation) (Figure 1). This belt was extensively explored for precious metal epithermal deposits in the 1980s – 1990s, but remains highly under-explored for copper porphyry systems.

A Message from Shawn Wallace, Executive Chair & Director:

“We are very pleased to announce the closing of our second acquisition this year. The Andrea aquisition represents an important step in our stated goal of populating the Company’s portfolio with highly leveraged copper and gold projects. Exploration at the Margarita copper-gold project, and now Andrea, will provide the Company, its shareholders and stakeholders with an exciting and potentially rewarding year as we rapidly advance both projects to drilling.”

Andrea Property:

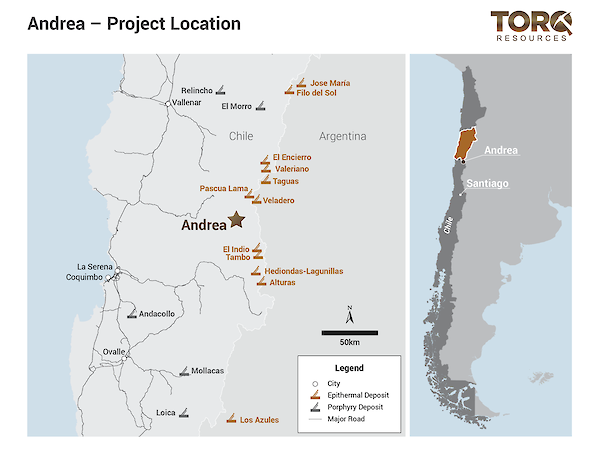

The project covers approximately 1,200 hectares at elevations ranging from 3900 – 4900 metres (m). The project is characterized by a 3.5 km by 1 km alteration system, situated along a north-south trending fault zone, that localizes the emplacement of multi-phase porphyry bodies, which are anomalous in copper, gold and molybdenum at an elevation of approximately 4,300 m (Figure 2). Importantly, the majority of the 3.5 km fault zone and associated mineralized porphyries, which represent the primary target area on the property, are situated under post-mineralization landslide and colluvium cover and remain undrilled (Figures 2 - 3).

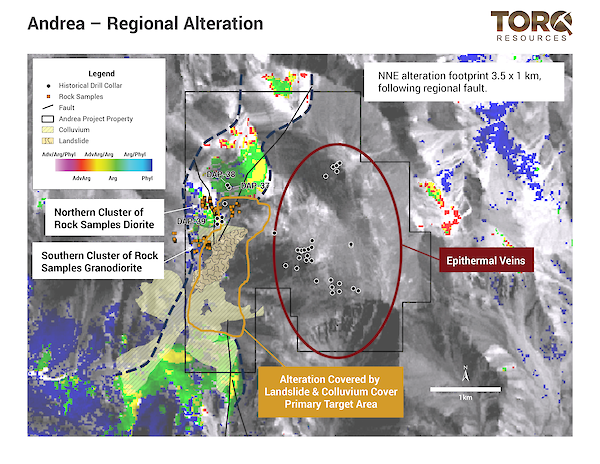

In addition, at higher elevations (4,600 – 4,800 m), to the east of the porphyry system, high-grade gold-silver low - intermediate sulphidation veins were mined historically by small-scale miners and drill tested by LAC Minerals in the 1990s. These epithermal veins, which constitute the Apolinario prospect, are not the focus of Torq’s exploration plans but their presence in conjunction with the mapped porphyries on the project demonstrate a full epithermal – porphyry continuum of the mineralization system is present on the property.

A Message from Michael Henrichsen, Chief Geologist:

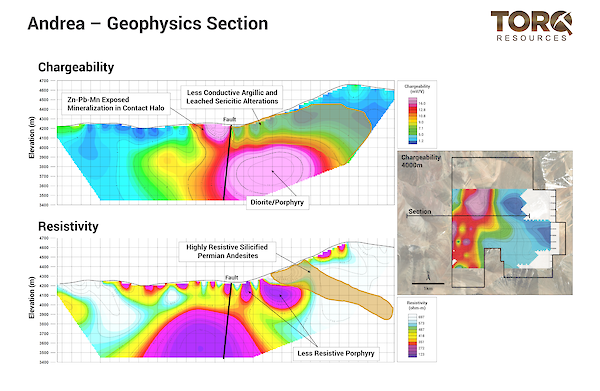

“The Andrea project represents an excellent opportunity to discover a world-class Miocene aged copper porphyry system in an area that has traditionally been explored for epithermal mineralization associated with the prolific El Indio belt. The presence of multiphase porphyry bodies with anomalous copper, gold and molybdenum values, in conjunction with large chargeability responses, demonstrates the potential of the project to deliver a new porphyry discovery.”

Geology & Geochemistry:

The property is primarily characterized by a north-south trending fault zone that separates Permo-Triassic siliceous volcanics to the east from a Mesozoic volcano-sedimentary package to the west. Multi-staged porphyries that are dioritic to granodioritic in composition are emplaced along this fault zone, with each phase having distinct alteration and mineralization characteristics. These porphyries are characterized by quartz-sericite alteration, quartz-magnetite veining and quartz - copper oxide stockwork veining zones, all of which are characteristics of a potentially productive porphyry system.

Historical grab sampling in the two limited areas where the porphyries are exposed are presented in Figure 2 and summarized below in Table 1. The historical grab samples on the Andrea project were collected by Santiago Metals and Noranda Inc. Torq has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these samples, nor can it confirm their accuracy or repeatability.

The southern cluster of rock samples largely represents a granodiorite phase porphyry that is associated with copper oxide quartz stockwork veins, which have average values of 551 parts per million (ppm) copper, 11.33 ppm molybdenum and 0.1 ppm gold. The northern cluster of rock samples is characterized by disseminated pyrite and minor copper sulphides, and is associated with quartz-magnetite veinlets in a diorite porphyry. Samples from the diorite porphyry average 508 ppm copper, 16 ppm molybdenum and 0.07 ppm gold. Collectively, these two porphyry phases indicate copper endowment along the fault zone and lead to Torq’s technical team’s pursuit of two targeting ideas at this stage: 1) The potential for an enrichment blanket at shallow depths associated with the granodiorite porphyry phase due to the presence of copper oxide on surface, and 2) the identification of a higher-grade porphyry phase under the landslide and colluvium material.

Table 1: Summary of historical rock sampling

Type | Number of Samples | Au (g/t) | Cu (ppm) | Mo (ppm) | |

|---|---|---|---|---|---|

Diorite Average Geochem | 107 | Minimum | 0.005 | 38 | 0.5 |

Maximum | 0.55 | 1,900 | 72 | ||

Mean | 0.069 | 508.6 | 16.45 | ||

Granodiorite Average Geochem | 162 | Minimum | 0.005 | 89 | 0.5 |

Maximum | 0.29 | 2,567 | 96 | ||

Mean | 0.103 | 551.3 | 11.33 |

Geophysics:

The results from an IP survey of the Andrea property conducted in 2014 demonstrate a robust 2.5 km by 1 km +18 millivolt chargeability anomaly that is largely situated underneath the landslide and colluvium cover, which represents the primary target area of the project (Figure 4). Importantly, internal to the chargeability high is a north-south trending corridor of lower chargeability values that may represent the potential for potassic alteration and high-grade mineralization internal to a pyritic halo that would be characterized by higher chargeability values.

Historical Drilling:

Seven drill holes, totalling 1,371 m and with a maximum depth of 250 m, tested the periphery of the main target area of the Andrea project (Figures 2 & 4). Only partial results are available from these drill holes and are listed below in Table 2. These results cannot be validated through assay certificates, however, Torq considers the partial results to be reliable as they were taken directly from historical company reports. The historical results from the drill holes were collected by Lac Minerals. Torq has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these drill samples, nor can it confirm their accuracy or repeatability.

Importantly, these drill holes did not test the chargeability anomalies that represent an important part of future drill targeting (Figure 4). The most significant intercept reported was 146 m of 980 ppm copper and 46 ppm molybdenum in drill hole DAP-37. Intervals in drill holes DAP-38 and DAP-39 also show discrete zones of elevated molybdenum values ranging between 76 and 203 ppm. The increasing copper and molybdenum values may represent a vector toward a higher-grade portion of the system at depth, which may be associated with the chargeability anomaly.

Andrea Historical Drilling

| Hole ID | North | East | Elevation | Azimuth | Dip | Length |

|---|---|---|---|---|---|---|

DAP-37 | 6,734,633 | 388,124 | 4,209.4 | 341 | -60 | 140.6 |

DAP-38 | 6,734,669 | 388,102 | 4,204.9 | 345 | -61 | 218.65 |

DAP-39 | 6,734,195 | 387,958 | 4,259.6 | 345 | -80.5 | 300 |

DAP-40 | 6,734,405 | 388,065 | 4,216.0 | 0 | -90 | 42.1 |

DAP-41 | 6,734,147 | 388,024 | 4,295.8 | 305 | -80 | 211.9 |

DAP-42 | 6,734,211 | 388,025 | 4,279.3 | 300 | -72 | 200 |

DAP-43 | 6,734,111 | 387,958 | 4,284.1 | 295 | -55 | 258.3 |

TOTAL | 1371.55 |

Andrea Assay Results, Historical Drilling

| Hole ID | From | To | Interval | Cu (ppm) | Au (g/t) | Mo (ppm) |

|---|---|---|---|---|---|---|

DAP-37 | 0 | 140.6 | 140.6 | 978 | 0.02 | 46 |

123 | 140.6 | 17.6 | 1314 | 0.1 | 102 | |

DAP-38 | 85 | 94 | 10 | 394 | 0.1 | 213 |

186 | 190 | 4 | 100 | 0.1 | 179 | |

DAP-39 | 9 | 30 | 21 | 1055 | 0.1 | 76 |

Exploration Plan:

Torq plans to advance the Andrea project to drill stage rapidly by conducting geological and alteration mapping, a rock sampling program and by creating a 3D inversion of the induced polarization data to define drill targets. The first drill program is being planned for Q1 of 2022.

Option Terms:

The Company acquired the rights that constitute the Andrea project through three option agreements. Under these option agreements the Company can acquire 100% interest in the project, subject to net smelter return (NSR) royalties, through cash payments as follows:

Period from Signing Definitive Agreement | Cash Payments (USD) |

|---|---|

Within 60 days of signing the Definitive Agreement | $105,000 |

within 12 months | 135,000 |

within 24 months | 185,000 |

within 36 months | 300,000 |

within 48 months | 1,000,000 |

within 60 months | 4,275,000 |

Total | $6,000,000 |

The option agreements each include a NSR of 1.5%, which is buyable for payments totalling US$3,000,000.

Figure 1: Illustrates the location of the Andrea project within the Miocene aged El Indio belt and its proximity to major deposits in the area.

Figure 2: Illustrates the 3.5 km by 1 km north south trending alteration zone, situated along a north south trending fault zone, which localizes the emplacement of multi-phase porphyry bodies that are anomalous in copper, gold, and molybdenum. Note that the majority of the alteration and fault zone are covered by post mineralization landslide and colluvium.

Figure 3: Illustrates the conceptual porphyry target underneath a thin cover of land slide and colluvium post mineralization cover. In addition, the presence of the high-grade epithermal veins at higher elevations demonstrates that the full porphyry – epithermal continuum is present on the Andrea property.

Figure 4: Illustrates the shallowly buried chargeability anomaly that has not been drill-tested and forms the primary target area on the Andrea property.

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD,

Shawn Wallace

Executive Chairman

For further information on Torq Resources, please contact Natasha Frakes, Manager of Corporate Communications at (778) 729-0500 or [email protected].

About Torq Resources

Torq is a junior exploration company focused on establishing a top-tier mineral portfolio. The Company’s management team has raised over $550 million and monetized successes in three previous exploration companies. Torq is continually reviewing mineral targets in pursuit of acquisition, strategic exploration and significant discovery.

Forward Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.